Iowa 529 Contribution Limits 2025

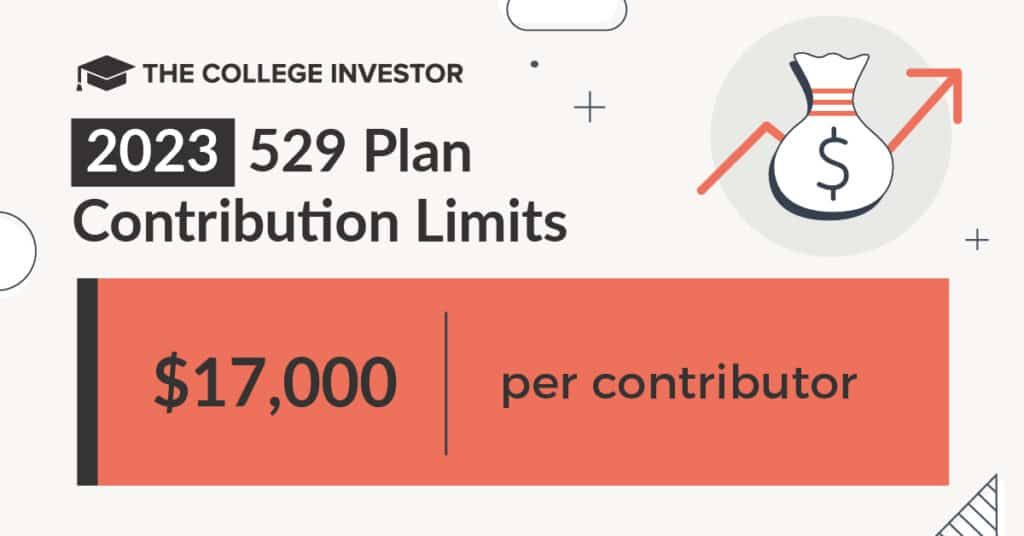

Iowa 529 Contribution Limits 2025. For 2025, if an iowa taxpayer is a college savings iowa or iadvisor 529 plan participant, they can deduct the first $4,028 they contribute per beneficiary account from their state. In 2025, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709.

Since each donor can contribute up to $18,000 per. Tax savings is one of the big benefits of using a 529 plan to save for college.

529 Plan Contribution Limits For 2025 And 2025, Iowa taxpayers can deduct up to $3,785 in contributions per beneficiary (student) account from their adjusted gross income for 2025. For 2025, if an iowa taxpayer is a college savings iowa or iadvisor 529 plan participant, they can deduct the first $4,028 they contribute per beneficiary account from their state.

529 Plan Contribution Limits in 2025, Tax savings is one of the big benefits of using a 529 plan to save for college. Iowa taxpayers can deduct up to $3,439 in contributions per beneficiary

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

Iowa 529 Contribution Limits 2025 Nevsa Adrianne, In 2025, you can contribute up to $17,000 to a 529 plan ($34,000 as a married couple filing jointly) and qualify for the annual gift tax exclusion, which lets you. So for example, a family of two parents and two children that.

50 Unbelievable Benefits of a 529 Plan Ultimate Guide 2025, Making contributions is easy by logging in through our website or with the readysave 529 app. Iowa taxpayers can deduct up to $3,785 in contributions per beneficiary (student) account from their adjusted gross income for 2025.

Max 529 Contribution Limits for 2025 What You Should Contribute, So for example, a family of two parents and two children that. “starting in 2025, the secure 2.0 act allows savers to roll unused 529 funds into the beneficiary’s roth ira without a tax penalty,” says lawrence sprung, author of financial.

529 Contribution Limits 2025 All you need to know about Max 529, Making contributions is easy by logging in through our website or with the readysave 529 app. “starting in 2025, the secure 2.0 act allows savers to roll unused 529 funds into the beneficiary’s roth ira without a tax penalty,” says lawrence sprung, author of financial.

529 Plan Maximum Contribution Limits By State Forbes Advisor, The contribution deduction amount changes yearly. Unlike retirement accounts, the irs does not impose annual contribution limits on 529 plans.

529 Plan Contribution Limits Rise In 2025 YouTube, A recent change to tax law will permit people to transfer funds directly from 529 plans to roth iras. Can i open accounts for more than one student?

529 Plan Contribution Limits (How Much Can You Contribute Every Year, Iowa taxpayers can deduct up to $3,785 in contributions per beneficiary (student) account from their adjusted gross income for 2025. In 2025, the annual 529 plan contribution limit rises to $18,000 per contributor.

529 Plan Contribution Limit 2025 Millennial Investor, In 2025, you can contribute up to $17,000 to a 529 plan ($34,000 as a married couple filing jointly) and qualify for the annual gift tax exclusion, which lets you. What are the potential iowa income tax benefits of a 529 account?