Due Date For Ct Sales Tax 2025

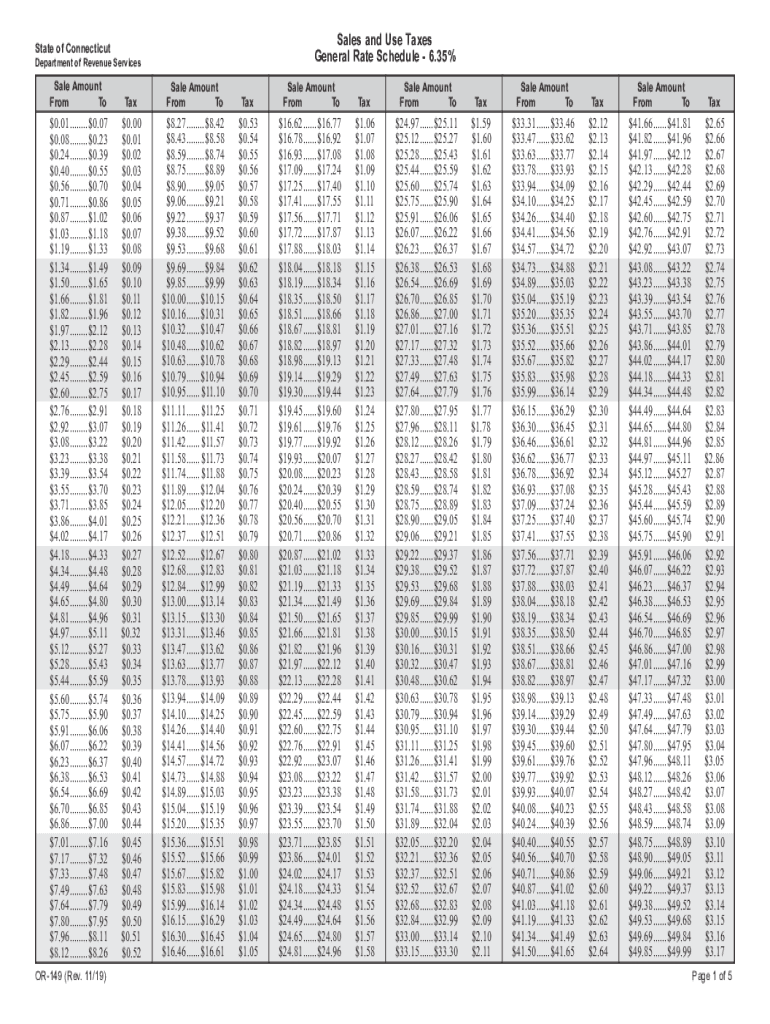

Due Date For Ct Sales Tax 2025. 2025 connecticut sales tax table. Connecticut c corporation tax deadlines for 2025.

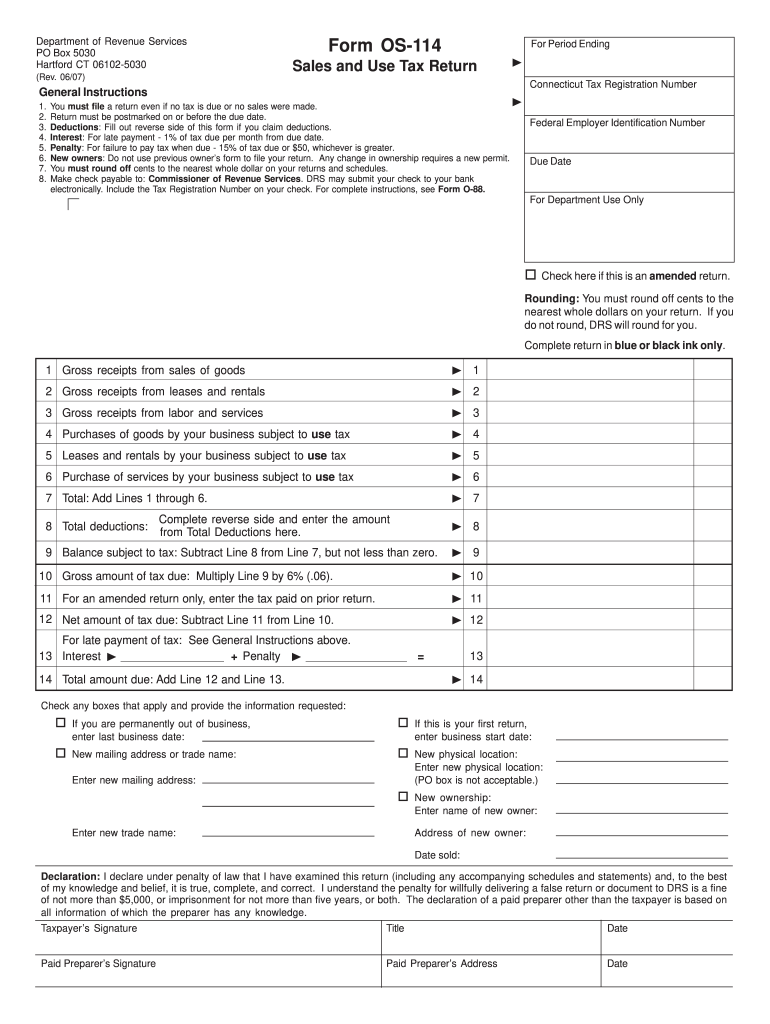

Ct Sales Tax Chart 20192024 Form Fill Out and Sign Printable PDF Template airSlate SignNow, Specifically, the 3% rate on the first $10,000 earned by unmarried individuals and the first $20,000 earned by married individuals filing jointly or earned by a person who files a. Connecticut business tax deadline for 2025.

Ct sales tax form Fill out & sign online DocHub, Connecticut state department of revenue services. Your required annual payment for the 2025 taxable year is the lesser of:

Tax Due Date Calendar 2025 Calendar Printables, There are no local taxes in connecticut, so the only rate you’ll have to worry about for most sales of taxable goods and services is the state tax of. The connecticut state sales tax rate is 6.35%, and the average ct sales tax after local.

Ct Tax Table 2025 Raye Mildred, Select to register for the upcoming withholding tax overview webinar on wednesday, july 24, 2025, at 10:00 a.m. Connecticut state department of revenue services.

What Is The Due Date For Tax Returns For 2025 Elaina Stafani, 2025 connecticut sales tax free week. Select to register for the upcoming sales and.

2025 Tax Filing Deadline Date Tedda Rickie, Select to register for the upcoming withholding tax. (1) incorrect interpretation of relief u/s 87a in case.

Sales Tax Due Dates 2025 Kalie Marilin, Select to register for the upcoming sales and. By sarah craig december 13, 2025.

2025 Tax Deadlines for the SelfEmployed, This comprises a base rate of 6.35% plus no additional mandatory local rates. Connecticut state department of revenue services.

Key Tax Dates For The SelfEmployed Forbes Advisor, Connecticut sales tax rates in 2025. 3 rd quarter returns and payments due on or before 10/31;

Quarterly Estimated Tax Payments 2025 Due Ebonee Collete, Connecticut c corporation tax deadlines for 2025. The sales tax rate of 6.35% applies to the retail sale, lease, or rental of most goods (including digital goods, which are described in special notice 2019(8), sales and.